What Is Statutory Income Malaysia

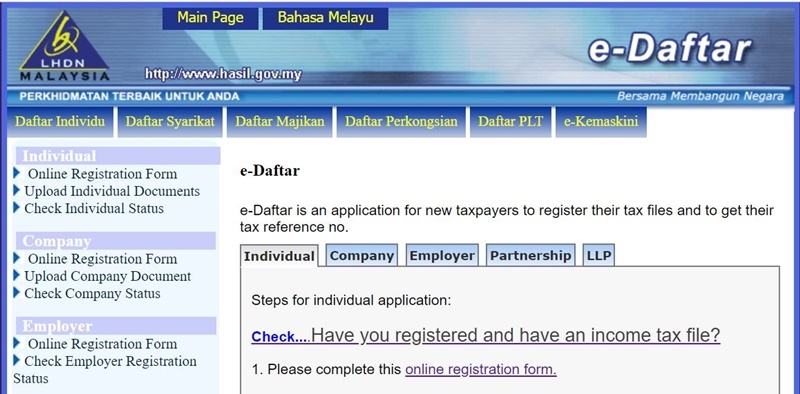

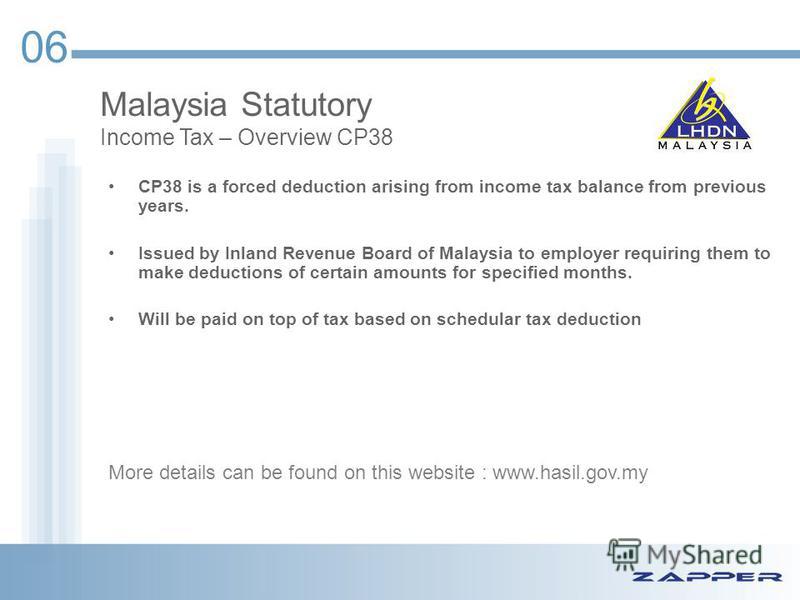

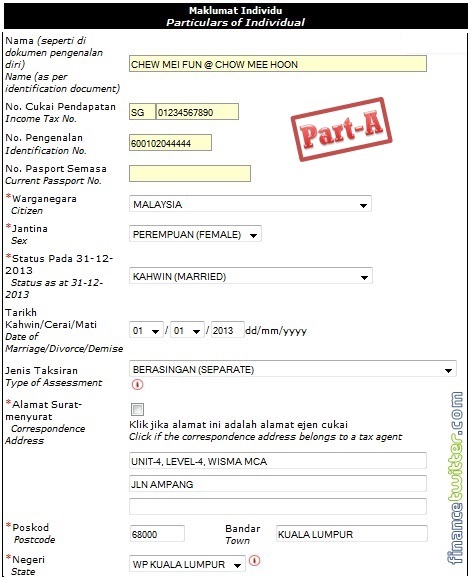

Since 2016 lembaga hasil dalam negeri lhdn has decided that anyone who earns an annual employment income of rm25 501 after epf deduction has to register a tax file.

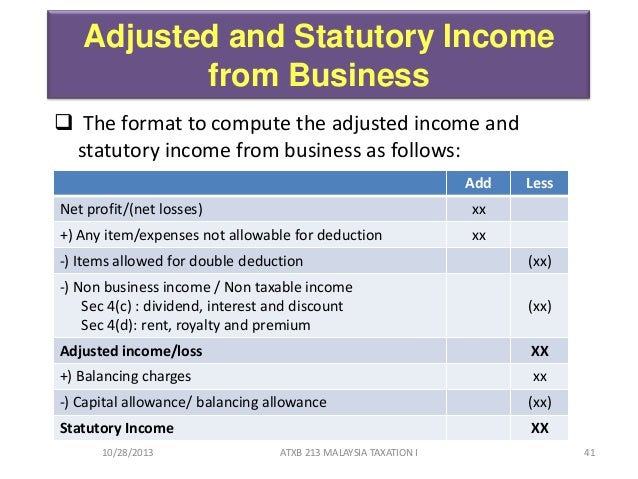

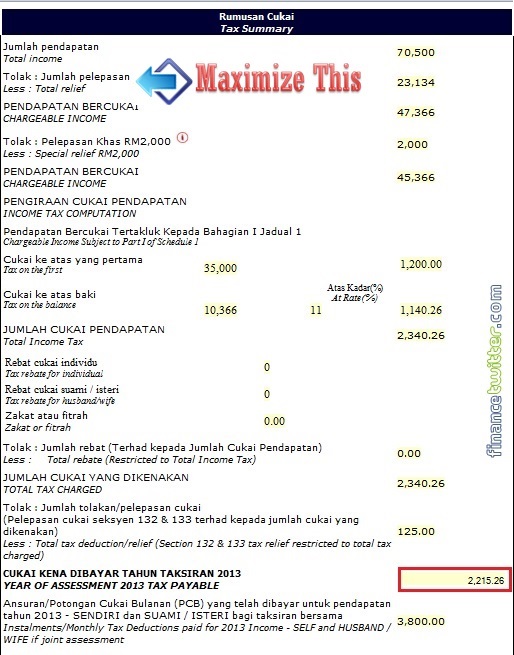

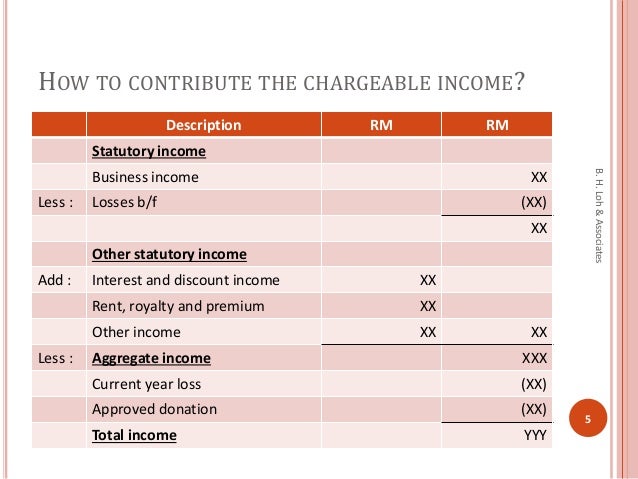

What is statutory income malaysia. This means that hr my will calculate the portion based on the percentage decided by you during payroll run. The form will automatically calculate your aggregate income for you. Statutory income chapter 6 aggregate income and total income 43. Chargeable income also known as taxable income is your total annual income minus all the tax exemptions and tax reliefs you are entitled to.

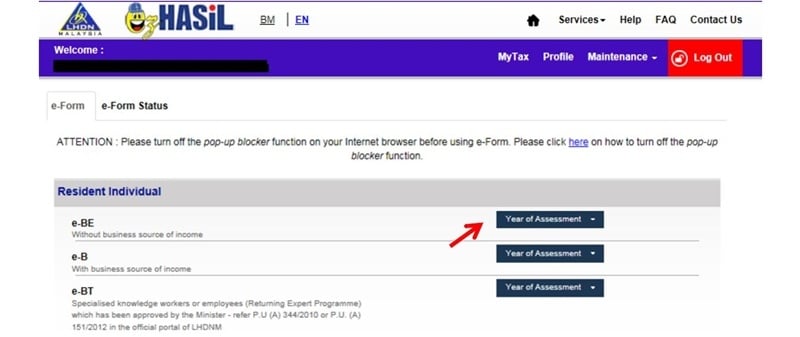

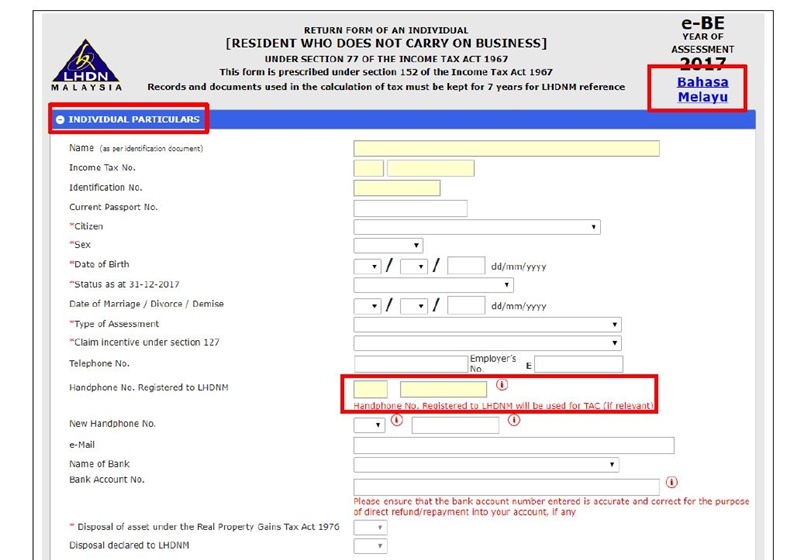

An easy way to know whether you need to pay up is to take a look at the ea form your hr department would give you. 42 1 subject to this act the statutory income if any of a person from a source for a year of assessment that year of assessment being in this section referred to as the relevant year shall consist of a the amount of his adjusted income if any from that source for the basis period for the relevant year. Klik sini untuk versi bm. In other words it s listed on your income tax forms under statutory income from rents for e filing and part b2 be form b7 b form for manual filing.

This is where your ea form comes into play as it states your annual income earned from your employer. When it comes to the season of income tax in malaysia that s when people tend to leave things till the last minute are you one of them and then make careless mistakes out of panic. Gross income gross income is the summation of basic salary variable pay bonus deduction. B the amount of i any balancing charge or the aggregate amount of the balancing charges.

The compulsory contributions under the employees provident fund epf act 1991. Carry back losses chapter 7 chargeable income 45. Group relief for companies 44 b. There s also an exemption of 50 on the statutory income of rental received by malaysian citizens who live in malaysia.

Total income 44 a. This page is also available in. Melayu malay 简体中文 chinese simplified statutory payroll contributions in malaysia employees provident fund. 6 laws of malaysia a ct 53 chapter 5 statutory income section 42.

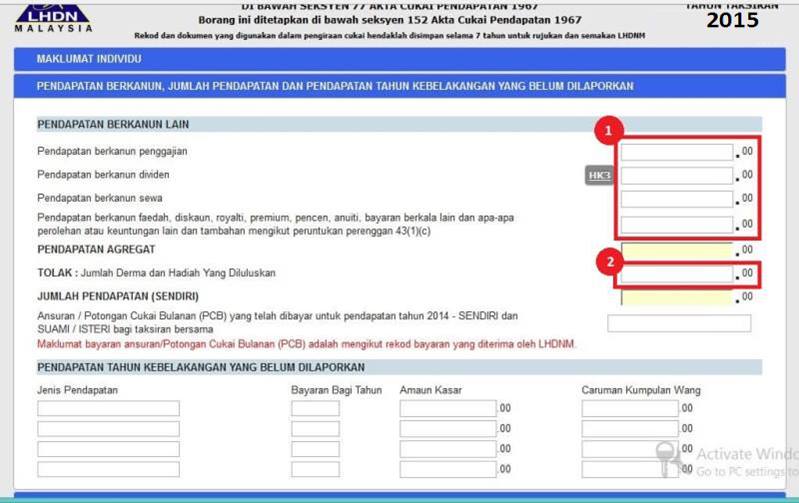

Under statutory income fill out all the money you earn from employment rents and other sources in the respective boxes. Go on to the malaysia income tax calculator to calculate how much tax you will have to pay. Here s an example of how to calculate your chargeable income. Too much math for you.

Hk 5 computation of statutory income from interest royalties 15 hk 6 tax deduction under section 110 others 16 hk 7 not applicable to form be not enclosed hk 8 income from countries which have avoidance of double taxation 17 agreement with malaysia and claim for section 132 tax relief items page. Some malaysians have been mistakenly reporting this as investment income and claiming it as tax exempt and have been penalised by the inland revenue board for doing so.